Last updated January 2026

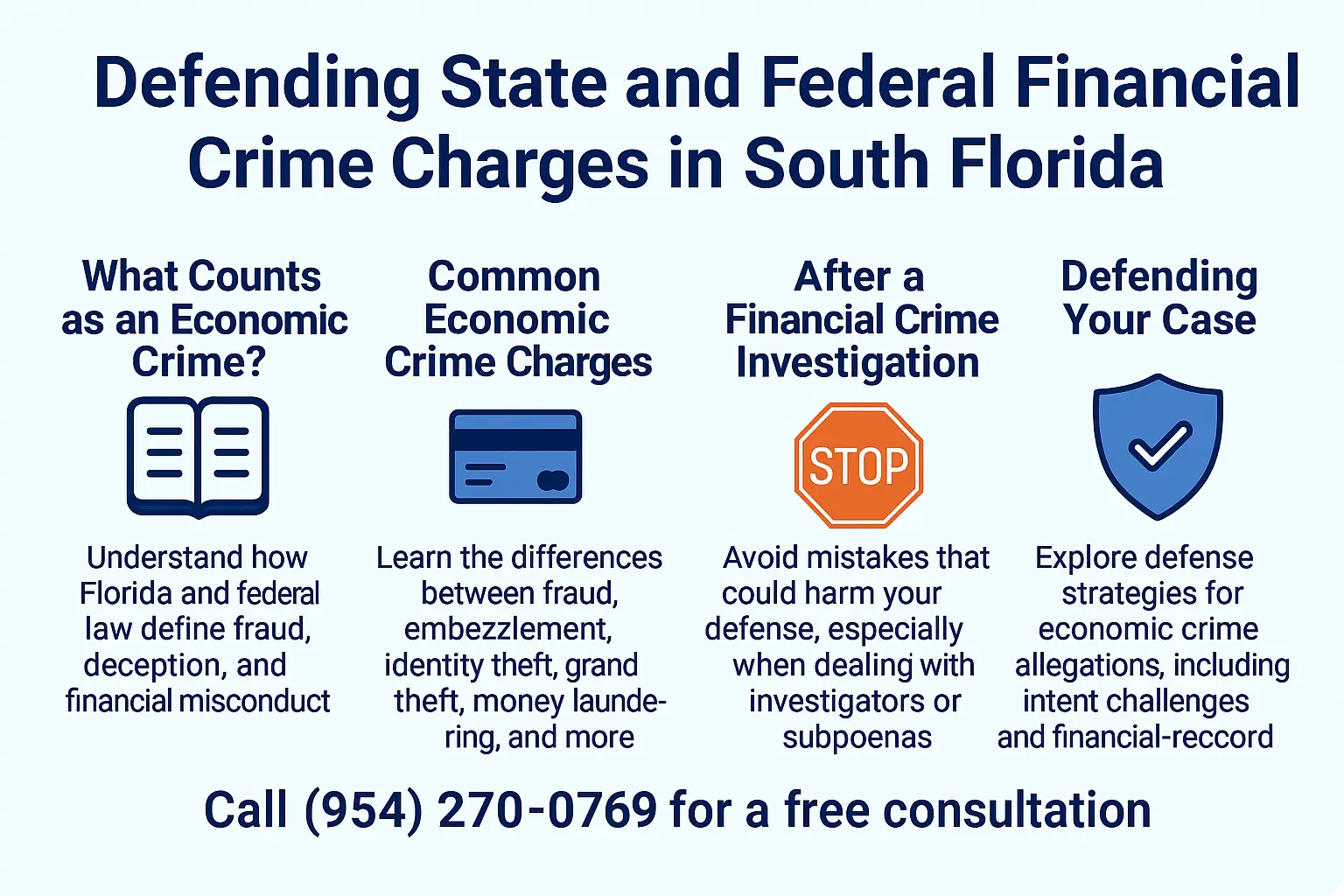

Defending State and Federal Financial Crime Charges in South Florida

If you are accused of fraud, embezzlement, or any other financial crime, you need an experienced economic crimes lawyer immediately. These cases move fast, involve multiple agencies, and often carry life-altering penalties — especially when federal prosecutors are involved.

At Michael White, P.A., we defend individuals and businesses facing economic crime investigations and charges in Fort Lauderdale, Broward County, Miami-Dade, Palm Beach County, and federal court. Whether you’ve received a subpoena, target letter, or formal charges, we act early to protect your rights, your reputation, and your future.

📞 Call (954) 270-0769 or schedule a confidential consultation today.

What Are Economic Crimes?

Economic crimes are non-violent offenses committed for financial gain. They are typically document-heavy, evidence-intensive, and aggressively prosecuted — particularly when banks, government funds, or interstate transactions are involved.

While often referred to as white-collar crimes, economic crimes encompass a broader category of financial and business-related offenses prosecuted under both Florida and federal law.

Common economic crime allegations include:

Fraud (bank, wire, mail, insurance, mortgage, tax)

Embezzlement and misappropriation of funds

Racketeering (RICO)

Money laundering (state and federal)

Healthcare and Medicare/Medicaid fraud

PPP loan fraud and SBA violations

Securities and corporate fraud

Bribery and public corruption

Forgery, check fraud, and financial falsification

These cases frequently involve forensic accounting, digital records, subpoenas, and multi-agency investigations.

State vs. Federal Economic Crime Charges

Economic crimes may be prosecuted in Florida state court or federal court, depending on how the conduct occurred and who was affected.

State cases are typically handled by local law enforcement and the State Attorney’s Office. Federal cases are investigated by agencies such as the FBI, IRS, DOJ, or U.S. Secret Service and prosecuted by the U.S. Attorney’s Office.

Federal charges often arise when allegations involve:

Interstate transactions

Banks or federally insured institutions

Government funds (PPP, Medicare, SBA)

Large loss amounts or multiple alleged victims

Federal prosecutions carry higher sentencing exposure, mandatory restitution, and asset forfeiture risks — making early legal strategy critical.

👉 Learn more about the differences between state and federal criminal charges in Florida.

Types of Economic Crime Cases We Defend

Our firm represents clients who are charged with — or under investigation for — a wide range of financial and business-related crimes, including:

Fraud and false statements

Federal wire fraud and mail fraud

Money laundering investigations

Racketeering and enterprise-based prosecutions

Tax-related offenses and IRS criminal cases

Healthcare billing and insurance fraud

Business and corporate crime allegations

If your case involves professional licensing risk, executive exposure, or federal prosecution, learn more about our focused white-collar crime defense services.

Penalties and Consequences of Economic Crimes

Penalties depend on the alleged conduct, loss amount, and whether the case is prosecuted at the state or federal level. Potential consequences include:

Felony convictions

Lengthy prison or federal sentencing exposure

Restitution orders in the tens or hundreds of thousands

Asset seizure and forfeiture

Loss of professional licenses or business interests

Long-term damage to reputation and employability

Even an investigation — before charges are filed — can jeopardize careers and businesses.

Our Defense Approach to Economic Crime Cases

Economic crime cases are not won by reacting late. They are won by early intervention, detailed analysis, and strategic pressure.

We routinely handle cases involving:

Grand jury subpoenas

Multi-agency investigations

Financial record analysis

Alleged intent or knowledge disputes

Our defense strategy focuses on:

Challenging intent, knowledge, and attribution

Attacking the government’s financial narrative

Identifying overreach, assumption-based charging, or flawed accounting

Negotiating pre-filing resolutions, diversion, or charge reductions

Aggressively litigating when prosecutors refuse to act reasonably

👉 Read how early legal intervention can change the outcome of a criminal case.

Speak With an Economic Crimes Defense Lawyer Today

Michael White is a former prosecutor who understands how financial crime cases are built — and how they fall apart. We provide discreet, strategic representation for clients facing serious economic crime allegations.

We defend clients throughout:

📍 Fort Lauderdale, Broward County, Miami-Dade, Palm Beach County, and federal courts in South Florida

📞 Call (954) 270-0769 or schedule your confidential consultation today.